cryptosouk.site

Overview

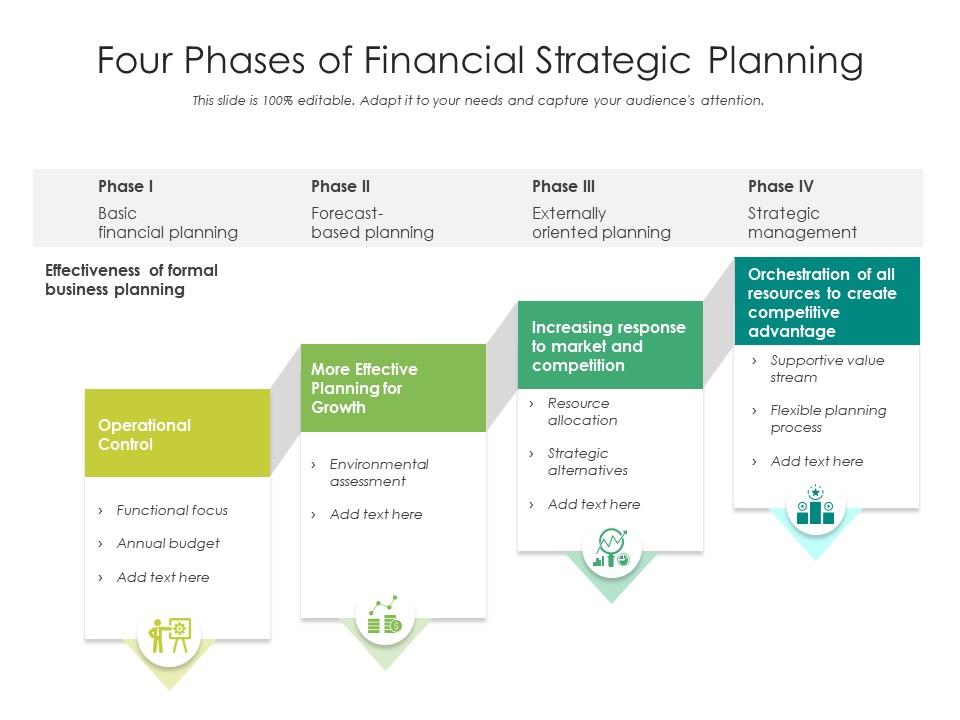

Strategy Of Financial Management

Finance strategy requires a balance of financial planning and strategic planning. The finance strategy should assess current resources, costs and budget; define. It helps you develop a vision for your company's success and becomes a set of controlling principles under which the company operates. A financial strategy is a. Strategic financial management goes beyond financial planning, budgeting, managing financial resources, controlling spend and liabilities, and mitigating risk. 2Leading and managing the departmental financial management function, including the following: Providing strategic financial and business advice to. It covers strategies of growth, mergers and acquisitions, financial performance analysis over the past decade, wealth created in terms of stock returns. Strategic finance works on many things, including optimizing the business, makes ROI determinations for future projects, and sizes the impact of. Foster an FM community of practice: Provide forums, tools, and experiences that promote information- sharing, networking, mentoring, and collaboration. Measuring investment and strategic performance: Master Balance Sheet insights, optimise Income Statement analysis and gauge customer value. Management choices. Strategic financial management is a term used to describe the process of managing the finances of a company to meet its strategic goals. Finance strategy requires a balance of financial planning and strategic planning. The finance strategy should assess current resources, costs and budget; define. It helps you develop a vision for your company's success and becomes a set of controlling principles under which the company operates. A financial strategy is a. Strategic financial management goes beyond financial planning, budgeting, managing financial resources, controlling spend and liabilities, and mitigating risk. 2Leading and managing the departmental financial management function, including the following: Providing strategic financial and business advice to. It covers strategies of growth, mergers and acquisitions, financial performance analysis over the past decade, wealth created in terms of stock returns. Strategic finance works on many things, including optimizing the business, makes ROI determinations for future projects, and sizes the impact of. Foster an FM community of practice: Provide forums, tools, and experiences that promote information- sharing, networking, mentoring, and collaboration. Measuring investment and strategic performance: Master Balance Sheet insights, optimise Income Statement analysis and gauge customer value. Management choices. Strategic financial management is a term used to describe the process of managing the finances of a company to meet its strategic goals.

The strategies for financial planning involve a systematic process of setting goals, evaluating resources, and outlining the steps needed to achieve those. Financial strategy is how a company plans to reach its short- and long-term goals. A company's financial strategy contains three major components: financing. Investors maximize their wealth by. © The Institute of Chartered Accountants of India. Page 2. Strategic Financial Management selecting optimum investment. Strategic financial management refers to the study and application of principles, concepts, and techniques that guide an organization to create value and. What is strategic financial management? Strategic financial management is the process of managing the finances of a company to meet the organisation's goals. 1. Setting financial goals · 2. Net worth statement · 3. Budget and cash flow planning · 4. Debt management plan · 5. Retirement plan · 6. Emergency funds · 7. Strategic financial planning is the process of determining how a business manages itself financially to ensure it achieves its goals and objectives for both. Building on key insights from stakeholders, business leaders, and market dynamics, a finance strategy includes focus areas, objectives, initiatives, and KPIs. 8 Strategies For Financial Success · 1. Develop a Budget · 2. Build an Emergency Fund · 3. Stretch Your Dollars · 4. Differentiate between Good Debt and Bad Debt · 5. Finance professionals need to continuously upskill and reskill to stay on top of the latest terminology, technology, and trends. Our ten-month Professional. The Department of Defense (DoD) Financial Management (FM) Strategy is the first-of-its-kind, Department-wide strategy to help prioritize the DoD FM. Enhanced Decision-Making: A clear financial strategy provides a roadmap for decision-making related to budgeting, investments, cost control. Strategy Development: With clear goals and an understanding of available resources and risks, developing a strategic financial plan is the next step. This. Ten top tips to improve your financial management · 1. Have a clear business plan · 2. Monitor your financial position · 3. Ensure customers pay you on time · 4. Financial strategy is how a company plans to reach its short- and long-term goals. A company's financial strategy contains three major components: financing. Finance theory assumes that a project will be evaluated against its base case, that is, what will happen if the project is not carried out. Managers tend to. Therefore, Strategic Financial Management are those aspect of the overall plan of the organisation that concerns financial management. This includes different. What is strategic financial management? Strategic financial management creates and manages a company's financial strategy aligned with its business objectives. Financial planning is the process of assessing the current financial situation of a business to identify future financial goals and how to achieve them. The.

Saving Schemes

Schemes · NPS PPF Capital Gains account Gold banking Senior Citizens Savings Scheme Sukanya Samriddhi Account Scheme RBI Bonds · Stocks & Securities · ASBA. Savings plan is a financial tool that helps you build a corpus for long-term and short-term financial goals while providing life insurance coverage. Some of the best savings schemes include the Post Office Monthly Income Scheme (POMIS), Recurring Deposits (RD), Public Provident Fund (PPF), etc. Savings scheme means a scheme designed to encourage savings by making small deposits. Generally, the Government of India, Banks or Public financial institution. Savings Schemes are investment options for Indian citizens launched by the government as well as other public sector financial institutions. Savings Plan. Saving schemes or plans are an important part of financial planning and long-term fin. The following are the 15 best savings plans to invest in National Savings Certificate. Senior Citizen Savings Scheme. Recurring Deposits. Post Office. CDNS attained membership of State Bank of Pakistan's Instant Payment System - RAAST for disbursement of profit of National Savings Schemes (NSS) in May, Are you looking for ways to save and invest for the future? Explore the different saving schemes available to you and discover which ones are the most. Schemes · NPS PPF Capital Gains account Gold banking Senior Citizens Savings Scheme Sukanya Samriddhi Account Scheme RBI Bonds · Stocks & Securities · ASBA. Savings plan is a financial tool that helps you build a corpus for long-term and short-term financial goals while providing life insurance coverage. Some of the best savings schemes include the Post Office Monthly Income Scheme (POMIS), Recurring Deposits (RD), Public Provident Fund (PPF), etc. Savings scheme means a scheme designed to encourage savings by making small deposits. Generally, the Government of India, Banks or Public financial institution. Savings Schemes are investment options for Indian citizens launched by the government as well as other public sector financial institutions. Savings Plan. Saving schemes or plans are an important part of financial planning and long-term fin. The following are the 15 best savings plans to invest in National Savings Certificate. Senior Citizen Savings Scheme. Recurring Deposits. Post Office. CDNS attained membership of State Bank of Pakistan's Instant Payment System - RAAST for disbursement of profit of National Savings Schemes (NSS) in May, Are you looking for ways to save and invest for the future? Explore the different saving schemes available to you and discover which ones are the most.

A pre-authorized plan that withdraws funds from an account you select, and deposits them into a Savings or Investment account on a regular schedule. Payroll saving is making regular savings directly from an employee's pay. An employer deducts the amount the employee wishes to save directly from wages via. Senior Citizens Savings Scheme (SCSS). SCSS is for the senior citizens to save tax. The people who are above 60 years of age can make an investment in this. The post office savings scheme includes saving instruments, offering several reliable and risk-free returns on investments. Saving schemes include bank deposits, post office schemes, and investments like NSC, KVP and Sukanya Samriddhi Yojana. Some of the best savings schemes include the Post Office Monthly Income Scheme (POMIS), Recurring Deposits (RD), Public Provident Fund (PPF), etc. Senior Citizens Saving Scheme, Interest Rates, Home Loan, Personal Loan, SB Account, Gold Loan, NRE SB Account, Education Loan, Auto Loan, Fixed Deposit. Post Office Saving Account · National Savings Recurring Deposit Account · National Savings Time Deposit Account · National Savings (Monthly Income Account) Scheme. INTRODUCTION: · Minimum deposit ₹/- & in the multiples thereof with maximum deposit of ₹30 lacs. · Click for Scheme Rule( and ) · Click for Scheme. The SCSS account is a robust and safe account designed especially for seniors to earn long term savings in their old age. set a savings goal, like saving for a house or holiday; save for children; save without paying tax. Plus, tricks to keep your saving on track. A Registered Retirement Savings Plan (RRSP) is an investment that allows you to plan for retirement, but can also be used to make a down payment on your first. The rates of interest on various Small Savings Schemes for the fourth quarter of financial year starting from 1 st January, and ending on 31 st. What are the risks of unregulated savings schemes? The main risk of putting money into a ROSCA, ASCA or savings club is that the scheme isn't governed by the. Different Types of Saving Schemes in India · Public Provident Fund (PPF) · National Savings Certificate (NSC) · Senior Citizens Savings Scheme (SCSS) · Post Office. Savings Schemes are investment options for Indian citizens launched by the government to help you achieve the financial goals. There are several options to. The scheme “Mahila Samman Savings Certificate” was launched by the Department of Economic Affairs, Ministry of Finance to provide financial security to. The aim of the Public Provident Fund (PPF) scheme offered by IDBI bank is to mobilize small savings by offering an investment with reasonable returns. Registered Education Savings Plans help to save towards a child's post-secondary education. Choose from Individual and Family Plans and start saving today. Post Office Saving Schemes - Explore different post office saving scheme & their interest rate including RD, post office time deposit, SCSS.

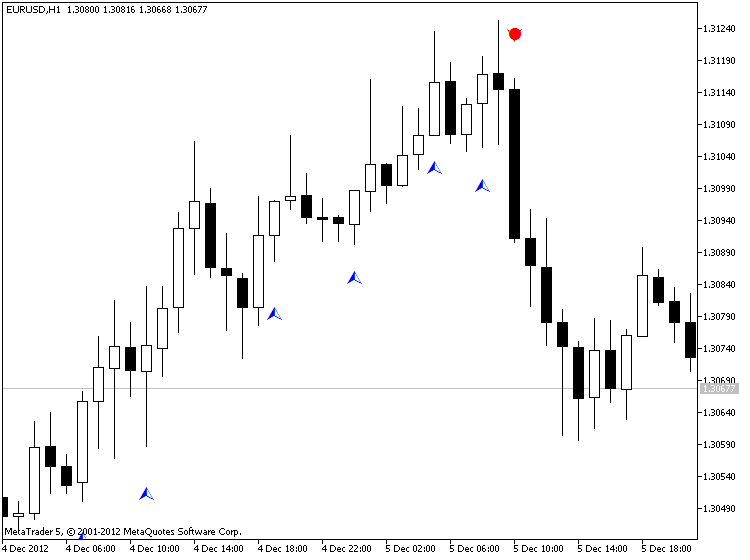

Mt5 Signals

Signal Provider is a trader who grants access to the data on his or her trading operations allowing other traders to copy them on their own trading accounts. To. Subscribe to MQL5 signals from the world's best traders for automatic trading on your Weltrade accounts round the clock. Signals is a convenient service for automatic copying of trading operations of professional traders directly to your account. What are the signals on MT5? author thumb By Telegram Forex signals. pic of nial fuller. Nial Fuller – Professional Trader & Investor. A trading room is a. Free Signal Indicators for MT4/MT5 - Download Now! Latest Collection as of Better versions of classic and most common signal indicators. Let me present you my best MT4 signal - cryptosouk.site Profit over %, 3 years on the market. Just watch it. Register on cryptosouk.site website as a Seller, specify your trading account and offer traders a subscription to copy your trades. It listens to alerts triggered on TradingView / signals posted on Telegram channels, then forwards them to MetaTrader (4 or 5) for instant execution. The MT5 trading signals service allows you to subscribe and copy the trades of more experienced traders or provide your strategies to other traders for a. Signal Provider is a trader who grants access to the data on his or her trading operations allowing other traders to copy them on their own trading accounts. To. Subscribe to MQL5 signals from the world's best traders for automatic trading on your Weltrade accounts round the clock. Signals is a convenient service for automatic copying of trading operations of professional traders directly to your account. What are the signals on MT5? author thumb By Telegram Forex signals. pic of nial fuller. Nial Fuller – Professional Trader & Investor. A trading room is a. Free Signal Indicators for MT4/MT5 - Download Now! Latest Collection as of Better versions of classic and most common signal indicators. Let me present you my best MT4 signal - cryptosouk.site Profit over %, 3 years on the market. Just watch it. Register on cryptosouk.site website as a Seller, specify your trading account and offer traders a subscription to copy your trades. It listens to alerts triggered on TradingView / signals posted on Telegram channels, then forwards them to MetaTrader (4 or 5) for instant execution. The MT5 trading signals service allows you to subscribe and copy the trades of more experienced traders or provide your strategies to other traders for a.

CopyFX is a copy trading platform that allows you to trade on the most popular and profitable MQL5 forex signals. Signals from MetaQuotes are a built-in service that allows copying trades on MetaTrader 4 and MetaTrader 5. Join the global community. The MQL5 community is home to a massive array of trading signals from providers who have been performance verified over a one month. IC Markets is one of our top-rated brokers with MetaTrader 5, which has its own MQL5 forex signal service (available on MT4 too). However, with MT5, the. Hundreds of FREE and paid Trading Signals for Meta Trader 5. This service allows the automatic copying of trades from one account to another. Demo or Live. What are the signals on MT5? Trading forex can be a profitable venture, but it requires knowledge and skills. Free forex signals are helpful tools. MQL5 is an online trading signal service that allows you to gain access to a great variety of signals and offer you option to copy your preferred signal. Trading signals are alerts or indicators generated by a trading system that suggest when to buy, sell, or hold an asset. MQL5 is a trading signal service that allows you to automatically copy (mirror trading) the trades of experienced traders on the MetaTrader platform. Signals from MetaQuotes are a built-in service that allows copying trades on MetaTrader 4 and MetaTrader 5. Learn how to sign up for MetaTrader 5 Trading Signals service and start copying trades into your MT5 account in just a few clicks! Start FREE Meta Trader! Am here to give free signals to mt5 traders. Also if you are not a trader and you want to know more, I will give all the information you need to know. To subscribe to a provider's deals, select a signal from the Signals tab of the platform, click Subscribe and enter your cryptosouk.siteity account password. Get real-time forex signals on your MT4 or MT5 platform, choosing from a range of signal providers and copying them directly on your Axiory trading account. MQL5 is an online trading signal service that allows you to gain access to a great variety of signals and offer you option to copy your preferred signal. Any MetaTrader 5 user can become a signal provider. To start offering your signal subscriptions to traders, you need to register as a seller first. Get real-time forex signals on your MT4 or MT5 platform, choosing from a range of signal providers and copying them directly on your Axiory trading account. The MQL5 Signals is a service that offers traders access to trading strategies with the use of trading signals. Copy trades of FOREXSTAY MT5 Forex Signal. Copy trading through trading free signals, Forex signals. It allows you to automatically copy transactions made by other market participants.

Life Insurance Investment Options

A wide range of financial products for personalized financial solutions · Annuities. Stable, long-term retirement savings options that eventually provide an. Builds cash value over time — so as your life grows, your policy does too (as long as you pay your premiums); A wide range of investment choices (within. Universal life insurance combines lifetime insurance coverage with the long-term growth potential of tax-advantaged investing. This type of universal life insurance allows policyholders to invest their cash value in one or more market-based investment option such as stocks, bonds or. A portion of your premium payment goes into the policy's cash value, which accrues either interest or market returns based on other investments. Your life. Choice of investment option – You choose the investment mix that suits your needs based on guaranteed interest options, managed money and equity-linked. It could be a good option for those who have reached the caps on their investment accounts, like (k)s, IRAs, and plans. Unlike whole life insurance, its cash value is invested in a portfolio of securities. As the policyholder, you can choose a mix of investments from those the. The answer is that most people would be better off getting a term policy and putting the rest of their money in other types of tax-free investments. A wide range of financial products for personalized financial solutions · Annuities. Stable, long-term retirement savings options that eventually provide an. Builds cash value over time — so as your life grows, your policy does too (as long as you pay your premiums); A wide range of investment choices (within. Universal life insurance combines lifetime insurance coverage with the long-term growth potential of tax-advantaged investing. This type of universal life insurance allows policyholders to invest their cash value in one or more market-based investment option such as stocks, bonds or. A portion of your premium payment goes into the policy's cash value, which accrues either interest or market returns based on other investments. Your life. Choice of investment option – You choose the investment mix that suits your needs based on guaranteed interest options, managed money and equity-linked. It could be a good option for those who have reached the caps on their investment accounts, like (k)s, IRAs, and plans. Unlike whole life insurance, its cash value is invested in a portfolio of securities. As the policyholder, you can choose a mix of investments from those the. The answer is that most people would be better off getting a term policy and putting the rest of their money in other types of tax-free investments.

Permanent life insurance with the opportunity to increase wealth. · Enjoy tax-advantaged investment growth · Leave a tax-free legacy for your loved ones · Build. High earners who have maxed out other tax-deferred investment options can benefit from investing with a whole life policy. In this case, buying life insurance. Sub-advised investment options include Separate Accounts available through a group annuity contract with Principal Life Insurance Co. Principal Funds. variable. Universal life · Meet a long-term life insurance need · Allocate premiums to investment options you choose · Supplement retirement income · Leave a legacy. You choose your investment accounts and growth can accumulate tax-free, within limits set by the government. You can withdraw or borrow from your policy, with. The benefits of variable universa life policies · Cash value · Flexible premiums & death benefit · Flexible investments · Option to de-risk over time · Automatic. Each State Farm insurer has sole financial responsibility for its own products. State Farm Life Insurance Company (Not licensed in MA, NY or WI) State Farm Life. Term life insurance, unlike permanent life insurance, doesn't have any cash value and therefore doesn't have an investment component If you're still alive. ULIPs or unit-linked insurance plans are generally regarded as one of the best investment options in India because they offer both life insurance and investment. Variable universal life insurance lets you invest your cash value in the stock market, so your policy value goes up or down based on the performance of your. Traditional variable life provides a minimum guaranteed death benefit, but many universal variable life products do not, and should investment experience be bad. The money in the account gets invested in a menu of investment options—typically mutual funds— that you can select. In addition, you may be able to allocate. Variable Universal Life Insurance gives you the same kind of lifetime protection and payment flexibility as standard universal life with more investment options. When you take out an indexed universal life insurance policy, the insurance company provides several options to select at least one index to use for all or part. The money in the account gets invested in a menu of investment options—typically mutual funds— that you can select. In addition, you may be able to allocate. So if you need a permanent life insurance policy that lets you make your own investment choices within your policy, consider variable universal life insurance . Term life insurance could provide your loved ones with the financial protection they need to maintain their lifestyle if you were no longer there. Protection. Variable life is a permanent life insurance policy with an investment component. · The death benefit and cash values vary. · The company invests your cash values. With such a wide range of investment options, you may adjust your policy's allocations to meet a potential lifetime of growth objectives and risk tolerances—all. The cash value inside your policy can grow or decline after you place it in a market-based investment option. 4. Flexible premium payments. Adjust how much to.

When Will The Gemini Credit Card Be Available

Given the Earn situation however, the CC/rewards is the only product of theirs I'm using until there's a resolution to my locked funds. Mastercard has decided to partner with the crypto exchange, Gemini in order to provide a new Cryptocurrency credit card that will enable cardholders to earn up. The Gemini Crypto Rewards Credit Card is Now Available in the United States · The first instant* crypto rewards credit card provides a seamless. This app is available only on the App Store for iPhone and Apple Watch. THE GEMINI CREDIT CARD®. Earn crypto rewards on every purchase. Up to 3. Your new card should arrive in the mail within days of being approved for the account. If I apply, will I get a metal card? Yes, all approved accounts will. The main benefit of the Gemini Credit Card is that you can earn rewards in the form of cryptocurrency through the Gemini Exchange. You can choose from more than. The Gemini Credit Card is now available in the U.S.! The Gemini Credit Card, which features Mastercard as the exclusive network. Since the Gemini Credit Card launched in April , customers have earned millions in crypto rewards. Cardholders who kept their crypto. The Gemini Mastercard card is a credit card created by one of the most trusted exchanges in the cryptocurrency space. Thanks to Gemini's regulatory compliance. Given the Earn situation however, the CC/rewards is the only product of theirs I'm using until there's a resolution to my locked funds. Mastercard has decided to partner with the crypto exchange, Gemini in order to provide a new Cryptocurrency credit card that will enable cardholders to earn up. The Gemini Crypto Rewards Credit Card is Now Available in the United States · The first instant* crypto rewards credit card provides a seamless. This app is available only on the App Store for iPhone and Apple Watch. THE GEMINI CREDIT CARD®. Earn crypto rewards on every purchase. Up to 3. Your new card should arrive in the mail within days of being approved for the account. If I apply, will I get a metal card? Yes, all approved accounts will. The main benefit of the Gemini Credit Card is that you can earn rewards in the form of cryptocurrency through the Gemini Exchange. You can choose from more than. The Gemini Credit Card is now available in the U.S.! The Gemini Credit Card, which features Mastercard as the exclusive network. Since the Gemini Credit Card launched in April , customers have earned millions in crypto rewards. Cardholders who kept their crypto. The Gemini Mastercard card is a credit card created by one of the most trusted exchanges in the cryptocurrency space. Thanks to Gemini's regulatory compliance.

available to credit card customers. I have never heard of any company having an provided is accurate. However, BBB does not verify the accuracy of. This organization is not BBB accredited. Credit Cards and Plans in New York, NY provided is accurate. However, BBB does not verify the accuracy of. Metal cards available in black, silver, and rose gold. Available to all U.S. residents; spend worldwide anywhere Mastercard is accepted. Integrations. See. Learn more about the benefits of Gemini's Credit card, a crypto rewards credit card and apply today. Get preapproved fast and start earning rewards today! Explore our in-depth Gemini Credit Card review. Discover its pros, cons, and if it's the right card for you. Learn more now! I got the Gemini CC in January when it first went live. You can basically earn rewards in any crypto that's traded on their platform. No photo description available. · · Gemini. . Feb 20 There is always a lo Gemini . Jun 28. . What happened. The main benefit of the Gemini Credit Card is that you can earn rewards in the form of cryptocurrency through the Gemini Exchange. You can choose from more than. Our values form the foundation of our culture, define the way we make decisions, and are the way of life at Gemini. We take great pride in our values and. To date, we have known Gemini as a leading crypto exchange that provides us with the opportunity to buy, sell, and trade with crypto assets. But this is not. I got the Gemini CC in January when it first went live. You can basically earn rewards in any crypto that's traded on their platform. The Gemini Credit Card will work like a traditional credit card, available to U.S. residents in every state and widely accepted wherever major cards are. Alternatively, you could buy crypto using a credit card issued by the trading platform, like the Gemini Mastercard or a cryptosouk.site VISA. But Lee Bratcher. Gemini: A simple, elegant, and secure way to buy bitcoin and other cryptocurrency. Get started today! The Gemini Credit Card® — 3% crypto back on dining. Gemini Credit Card is your gateway to effortless crypto investments. Earn rewards in Bitcoin, Ethereum, or other cryptocurrencies with every purchase. Conversely, the Gemini Credit Card deposits cryptocurrency directly into your Gemini card is available to everyone. So before applying, be sure to. Gemini Trust Company, LLC (Gemini) is an American cryptocurrency exchange and custodian bank. It was founded in by Cameron and Tyler Winklevoss. Gemini Mastercard Credit Card is Card that would exceed your Available. Credit. For purposes of determining your Available Credit, we do not give effect to. Gemini has made Mastercard the exclusive card network for its bitcoin-back credit card, which will launch this summer. Salt Lake City, UT-based WebBank will. Gemini Earn offers instant withdrawal with no fees, and is available in Singapore. Pros. Gemini Credit Card. Gemini also comes with a Mastercard credit card for.

20 Ways To Save Money

1. Eliminate Your Debt. If you're trying to save money through budgeting but still carrying a large debt burden, start with your debt. · 2. Set Savings Goals · 3. There are lots of ways to spend less money without making any drastic changes to your lifestyle. Here are 20 simple ways to cut costs and save money as a. 20 money saving tips you can use every day · 1. Switch to spend less on your utilities · 2. Change banks and get free cash · 3. Cancel unnecessary commitments. And yes, they can still save you money. Unlike 20 years ago, using coupons doesn't need to involve cutting little squares out of your local newspaper. If you're new to the site, first check out the big family savings; give yourself a Money Makeover to ensure you're getting the best deal on all your finance. 20 Easy Ways to Save Money Long Term · 1. Turn off hot water rinses and heated dry settings on your dishwasher. · 2. Mix your laundry soap with water, Borax, and. MSN cryptosouk.site, 20 Ways to Save on a Shoestring. BY MP DUNLEAVEY. Savings. When you hear that word, do you feel a clutching sense of guilt and inadequacy. Try to allocate 20% of your net income to savings and investments. · Americans are notoriously bad at saving and the U.S. has extremely high levels of debt. · The. Follow these 20 surprisingly simple ways and save money in your daily life effortlessly. Find the ways that work best for you, and gradually start including. 1. Eliminate Your Debt. If you're trying to save money through budgeting but still carrying a large debt burden, start with your debt. · 2. Set Savings Goals · 3. There are lots of ways to spend less money without making any drastic changes to your lifestyle. Here are 20 simple ways to cut costs and save money as a. 20 money saving tips you can use every day · 1. Switch to spend less on your utilities · 2. Change banks and get free cash · 3. Cancel unnecessary commitments. And yes, they can still save you money. Unlike 20 years ago, using coupons doesn't need to involve cutting little squares out of your local newspaper. If you're new to the site, first check out the big family savings; give yourself a Money Makeover to ensure you're getting the best deal on all your finance. 20 Easy Ways to Save Money Long Term · 1. Turn off hot water rinses and heated dry settings on your dishwasher. · 2. Mix your laundry soap with water, Borax, and. MSN cryptosouk.site, 20 Ways to Save on a Shoestring. BY MP DUNLEAVEY. Savings. When you hear that word, do you feel a clutching sense of guilt and inadequacy. Try to allocate 20% of your net income to savings and investments. · Americans are notoriously bad at saving and the U.S. has extremely high levels of debt. · The. Follow these 20 surprisingly simple ways and save money in your daily life effortlessly. Find the ways that work best for you, and gradually start including.

No matter where you are in your money-saving journey towards financial peace, these tips will help you along the way. If you do it right, going green can save you money. Lots of it. Here are some ways that will help you get started. I have some money that's saving up that I'm just dumping into my savings account with like a % return. How can I best make use of this money? Generally, a common guideline is the 50/30/20 rule, where 50% of your income is put aside for your needs, 30% for your wants, and 20% for savings and. The key to eating well, saving money, and proactively making your health a priority when it comes to food, is mostly planning and preparation. Save first, spend later. Keep aside, say, 20% of your income for savings every time you get paid before doing anything else. This way, you'll be saving. Saving 20 dollars a day adds up to about $ a month or $7, each year! Save $ for 20 years compounded at 5% and you'll have $,—over a quarter of a. The rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. 20 Easy Ways to Save Money in Your Business · 1. Set up a daily cash flow report to control all cash in and out; this may help protect you from wrongful trading. One of the most effective ways to reduce household expenses is to set a budget—and stick to it. A budget can help you see where your money is going and identify. Record your expenses · Include saving in your budget · Find ways to cut spending · Set savings goals · Determine your financial priorities · Pick the right tools. 1. Eliminate Your Debt. If you're trying to save money through budgeting but still carrying a large debt burden, start with your debt. · 2. Set Savings Goals · 3. This simply means that every month you allot 50% of your income to necessary expenses, 30% to wants, and 20% to savings and debt repayment. And by using a. 20 Easy Ways to Save Money Long Term · 1. Turn off hot water rinses and heated dry settings on your dishwasher. · 2. Mix your laundry soap with water, Borax, and. Here are our top 20 tips to help you get better at saving money: 1. Record your income. When it comes to saving, the first step is to know how much you earn. This will save you around £14 a year on your annual energy bills. Replace your bulbs as and when you can with energy efficient LEDs – on average it could save. 8 ways to save money quickly · 1. Change bank accounts. · 2. Be strategic with your eating habits. · 3. Change up your insurance. · 4. Ask for a raise—or start job. 9 money moves to make in your 20s · 1. Build your confidence with an emergency account. · 2. Align your spending with what you care about. · 4. Build a solid. The final 20% of your budget should go toward savings. Here is a tool that will help you set your budget using the method. Save Money. Entering a. Here are our top 20 tips to help you get better at saving money: 1. Record your income. When it comes to saving, the first step is to know how much you earn.

Roth Ira Household Income Limit

As a couple, you can contribute a combined total of $14, (if you're both under 50) or $16, (if you're both 50 or older) to a traditional IRA for If. There is no tax deduction for contributions made to a Roth IRA, however all future earnings are sheltered from taxes, under current tax laws. The Roth IRA can. The Roth IRA income limit to make a full contribution in is less than $, for single filers, and less than $, for those filing jointly. Self-Directed Roth IRA Eligibility ; Age 49 and younger, $/$6, ; Catch Up Contributions Provision Age 50+, $1,/$1, ; Total Contributions If Over Age. Income limits for Roth IRAs · $, to $, for individuals filing as single or head of household · $, to $, for married couples filing jointly. Anyone, of any age, subject to certain income limits, as long as the designated beneficiary (the child for whom a contribution is made) is younger than The Roth IRA contribution limit for is $7, for those under 50, and $8, for those 50 and older. Your personal Roth IRA contribution limit. Is phased out completely when your income is more than $, if you are Single or Head of Household, or $, if Married Filing Jointly; Married couples. Your modified adjusted gross income must be less than: $, - Married filing jointly. $10, - Married filing separately (and you lived with your spouse at. As a couple, you can contribute a combined total of $14, (if you're both under 50) or $16, (if you're both 50 or older) to a traditional IRA for If. There is no tax deduction for contributions made to a Roth IRA, however all future earnings are sheltered from taxes, under current tax laws. The Roth IRA can. The Roth IRA income limit to make a full contribution in is less than $, for single filers, and less than $, for those filing jointly. Self-Directed Roth IRA Eligibility ; Age 49 and younger, $/$6, ; Catch Up Contributions Provision Age 50+, $1,/$1, ; Total Contributions If Over Age. Income limits for Roth IRAs · $, to $, for individuals filing as single or head of household · $, to $, for married couples filing jointly. Anyone, of any age, subject to certain income limits, as long as the designated beneficiary (the child for whom a contribution is made) is younger than The Roth IRA contribution limit for is $7, for those under 50, and $8, for those 50 and older. Your personal Roth IRA contribution limit. Is phased out completely when your income is more than $, if you are Single or Head of Household, or $, if Married Filing Jointly; Married couples. Your modified adjusted gross income must be less than: $, - Married filing jointly. $10, - Married filing separately (and you lived with your spouse at.

Currently, Roth contribution limits for those under 50 are $6, and $7, for those 50 and older. Unlike with the Traditional IRA or (k), contributions. Roth IRA MAGI Limits ; Filing Status. Modified Adjusted Gross Income (MAGI). Contribution Limit ; Single or Head of Household. Less than $, Full. Income limits for Roth IRAs · $, to $, for individuals filing as single or head of household · $, to $, for married couples filing jointly. Self-Directed Roth IRA Eligibility ; Age 49 and younger, $/$6, ; Catch Up Contributions Provision Age 50+, $1,/$1, ; Total Contributions If Over Age. All head-of-household filers must have incomes of $57, or less in Single taxpayers must have incomes of $38, or less in The amount of credit. Roth IRA income limits. ; Single · Head of household · Married filing separately (if you didn't live with your spouse in ) · $, or more, Not eligible. Married filing jointly or head of household For the purposes of this calculator, the tool assumes that your income does not limit your ability to contribute. There are income restrictions on the Roth. If you are single, your income must be less than $95, (MAGI - modified adjusted gross income) in order to be. Roth IRA contributions ; Single, head of household, or married filing separately & did not live with spouse ; Your MAGI, What you can contribute ; Less than. For , singles or heads of household can make full contributions to a Roth IRA if their MAGI is below $, However, the contributions start phasing out. The maximum amount you can contribute to a Roth IRA for is $7, (up from $6, in ) if you're younger than age If you're age 50 and older, you. You can contribute the full amount as a single if your income is less than $, However, if you are married your combined income must be. #3: You must stay below income limits to contribute to a Roth IRA If you file taxes as a single person, your modified adjusted gross income (MAGI) must be. Traditional and Roth IRA. Annual Contribution Limits. , Age 49 and Income tax filing status — single, head of household or married filing jointly. There are no income limits for converting Traditional IRA assets to a Roth IRA. · For married taxpayers filing separately: If you did not live with your spouse. Roth IRA Income Limits ; Married filing jointly or qualifying widow(er), Less than $,, Less than $, What income types to count in your estimate · Alimony from divorces and separations finalized before January 1, · Capital gains · Excluded (untaxed) foreign. Contribution limits. The Roth IRA contribution limit is $6, in or the total of earned income for the year, whichever is less. If a child earns. Whether or not you can make a full contribution depends on your tax filing status and modified adjusted gross income (MAGI). Single: MAGI less than $, Single or Head of Household - Active Participant, $73, - $83,, $77, Roth IRA Contribution Limits Modified Adjusted Gross Income Phase-Out Ranges.

What Is The Standard Fee For A Financial Advisor

Fee-Only planners are compensated directly by their clients for advice, plan implementation and for the ongoing management of assets. The National Association of Personal Financial Advisors is the leading association of fee-only financial advisors. Visit us today to find an advisor near. A typical account between mil gets charged %. Transaction Fee. Reduced Transaction Fee* ; Electronic Trades. $ $24 ; Broker-Assisted Trades. $ $45 ; Automatic Investment Plan (AIP) Trades:** N/A. $ Some financial advisors will charge a set fee for their services. These fees may take the form of an hourly rate, a project fee, or a percentage of assets. Your first meeting with an Ameriprise financial advisor is always free, but what costs and fees can you expect when working with an advisor? Learn more. Fee-Only planners are compensated directly by their clients for advice, plan implementation and for the ongoing management of assets. Financial advisor fees vary widely making it difficult to standardize an "average" that you should expect. Flat fee advisors will typically charge somewhere. Flat-rate fees range from $1, to $5, for a one-time charge. And remember: As stated above, that gets you started with a moment-in-time plan, and it. Fee-Only planners are compensated directly by their clients for advice, plan implementation and for the ongoing management of assets. The National Association of Personal Financial Advisors is the leading association of fee-only financial advisors. Visit us today to find an advisor near. A typical account between mil gets charged %. Transaction Fee. Reduced Transaction Fee* ; Electronic Trades. $ $24 ; Broker-Assisted Trades. $ $45 ; Automatic Investment Plan (AIP) Trades:** N/A. $ Some financial advisors will charge a set fee for their services. These fees may take the form of an hourly rate, a project fee, or a percentage of assets. Your first meeting with an Ameriprise financial advisor is always free, but what costs and fees can you expect when working with an advisor? Learn more. Fee-Only planners are compensated directly by their clients for advice, plan implementation and for the ongoing management of assets. Financial advisor fees vary widely making it difficult to standardize an "average" that you should expect. Flat fee advisors will typically charge somewhere. Flat-rate fees range from $1, to $5, for a one-time charge. And remember: As stated above, that gets you started with a moment-in-time plan, and it.

In a recent study, McKinsey found that the advisors covered by their survey were charging an average annual fee of just over 1% on assets under management for. The advisory fee typically ranges from % of the amount invested; the rate is generally influenced by asset size and services provided. According to the most recent available data, the average AUM fee for a financial advisor is between % and %. Advisor pay structure: AUM fee. Average. % of the assets under management. The percentage fee charged typically covers comprehensive financial planning services in addition to investment management. Advisors will often charge at least $/hour as their hourly rates. It is not uncommon to see more experienced advisors charging hundreds of dollars. In a fee-based account clients pay a quarterly fee, based on the level of assets in the account, for the services of a financial advisor as part of an advisory. A fee-only financial advisor is an advisor whose only source of compensation from working with their clients are fees paid to the advisor by the client. Fee-. According to Advisor Ratings, the average cost of a financial advisor is about $3, As with any profession, this can increase to upwards of $30, depending. "Fee-only financial planners are registered investment advisors with a fiduciary responsibility to act in their clients' best interest. They do not accept any. 88% (the industry average for a $3,, portfolio). That is $26, per year out of your pocket (or, more likely, your investment portfolio). Fast forward a. Costs Of Hiring A Financial Advisor · Percentage of Assets Managed: Advisors may charge between % to 2% of your managed assets annually. · Flat Fees. Financial advisor careers · Real financial planning · Leading-edge technology Fees paid to the fund's manager and/or portfolio advisors for investment. Further, a Registered Investment Advisor must explain upfront how they receive compensation. Fees range but generally average somewhere between % of the. What about percentage-based financial advisor fees? The percentage fee advisor charges an ongoing fee (typically around 1% of assets under management), and. We are fee-only fiduciary financial planners which means we: Always act in (Hourly rate: $). usually between hours. Low to Moderate. Advisors in Australia often charge an annual fee based on a percentage of assets under management (AUM), typically ranging from % to %. certain levels of investment in the program) and to certain strategy fee rate caps. The transaction fee is not payable to your Advisor. Exchange funds. • You. The average advisor fees charged by brokerage range from % to %, depending on client assets. Wells Fargo Advisors Fees vary by relationship type and services provided. Learn about investment advisory services, brokerage and related fees. We provide financial planning and advice at an hourly rate of $ We start off every relationship with a new client with a flat fee comprehensive plans so.

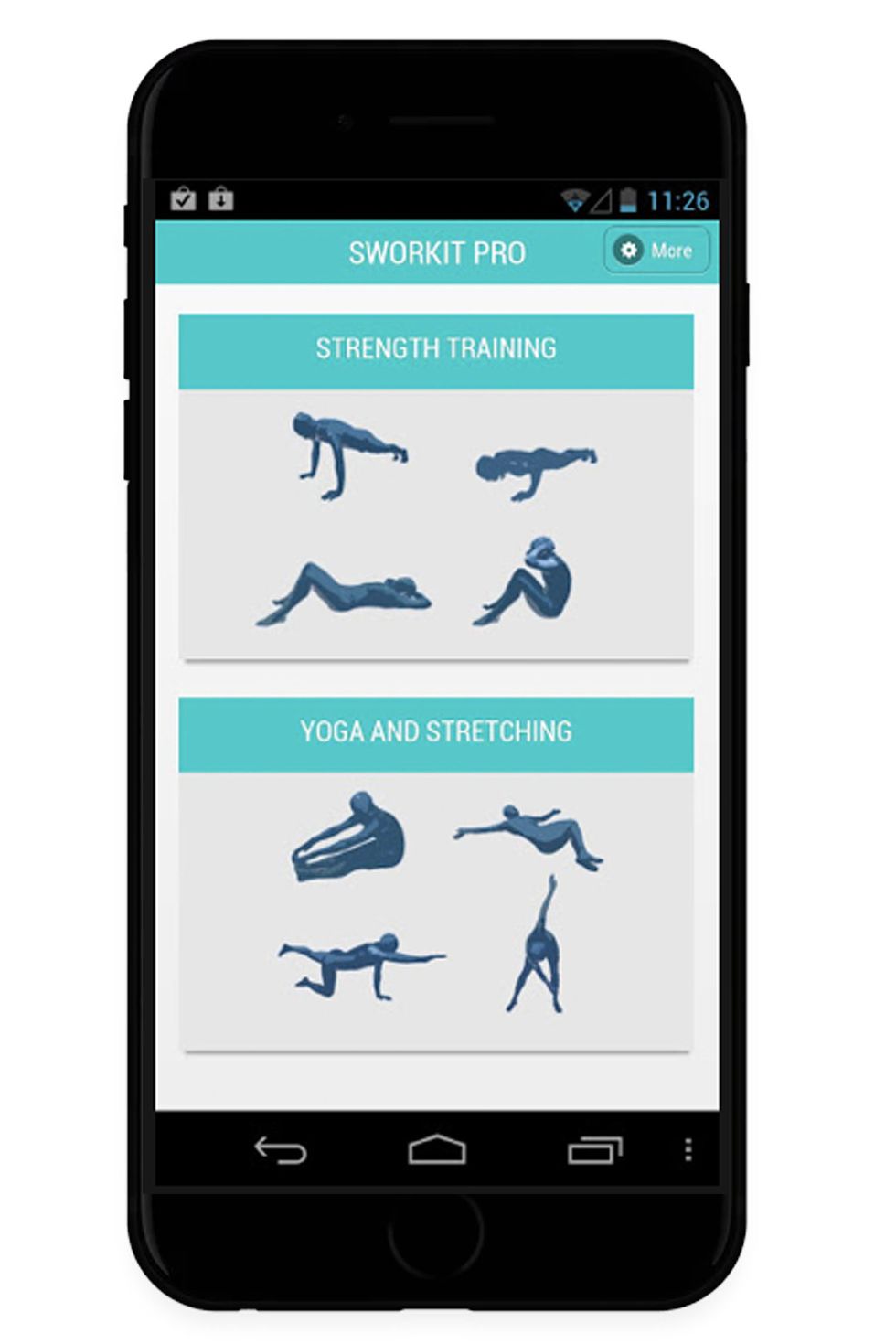

Best Workout And Fitness Apps

Top Pick - Boostcamp: cryptosouk.site #2 - Hevy: cryptosouk.site #3 - Strong App: cryptosouk.site #4. Paired with Fitbit smart watches or activity trackers, Fitbit Coach provides a wide variety of workouts targeted towards goals like weight loss, heart health. The Workout App: Optimize your workout results at the gym & at home. Build muscle & lose weight with a custom workout routine for your fitness goal and body. Best digital home or gym training experience ⚡ Shred app provides a dynamic, personalized training experience ⚡ Workouts app on iOS or Android. Transform your fitness journey with JEFIT - the #1 workout tracking app. Track your workouts, monitor your progress, and achieve your fitness goals with. Here are the best free fitness apps to try: · Best Overall Fitness App – Caliber · Most Hands-On App – FitOn · Most Supportive App – MapMyFitness by Under. BETTER POINTS · Just dance now app screenshot · Fitness RPG app screenshot · Stand up app screenshot · one you couch to 5k app · Daily fitness workout app · Adidas. So, beyond convenience, what are the benefits of exercising via a workout app? Great question — I'm glad you asked. It's important to note that not all exercise. Some popular workout apps that offer automated features and customizable workout plans include Nike Training Club, Fitbod, MyFitnessPal, JEFIT. Top Pick - Boostcamp: cryptosouk.site #2 - Hevy: cryptosouk.site #3 - Strong App: cryptosouk.site #4. Paired with Fitbit smart watches or activity trackers, Fitbit Coach provides a wide variety of workouts targeted towards goals like weight loss, heart health. The Workout App: Optimize your workout results at the gym & at home. Build muscle & lose weight with a custom workout routine for your fitness goal and body. Best digital home or gym training experience ⚡ Shred app provides a dynamic, personalized training experience ⚡ Workouts app on iOS or Android. Transform your fitness journey with JEFIT - the #1 workout tracking app. Track your workouts, monitor your progress, and achieve your fitness goals with. Here are the best free fitness apps to try: · Best Overall Fitness App – Caliber · Most Hands-On App – FitOn · Most Supportive App – MapMyFitness by Under. BETTER POINTS · Just dance now app screenshot · Fitness RPG app screenshot · Stand up app screenshot · one you couch to 5k app · Daily fitness workout app · Adidas. So, beyond convenience, what are the benefits of exercising via a workout app? Great question — I'm glad you asked. It's important to note that not all exercise. Some popular workout apps that offer automated features and customizable workout plans include Nike Training Club, Fitbod, MyFitnessPal, JEFIT.

MyFitnessPal is a workout app that integrates nutrition, exercise, and overall health tracking. Garnering over million downloads on major app stores, it was. Where the app shines:Freeletics offers a variety of workouts, which can be personally tailored. The workouts are short, challenging and are ideal for training. Instagram is my go-to source for free healthy recipes, meal plans and workout videos. Here's why you should use it too. Best training I've had since college athletics. If you're looking for fun and functional workouts that will push you, start with Body+Bell on the Ladder App. I've been using Gymshark Training both on Android and iphone. It was great, lots of workout plans based on equipment, time, which part of the. The Best Health And Fitness Apps · Strava · Fiit · Nike Run Club · Les Mills+ · EXi · Zwift · Cyclemeter · MyFitnessPal. Intro · Strong Fitness App · Hevy Fitness App · GymShark66 Fitness · Way Down Fit App Thank you so much for watching my. What is the Best Workout Music App? · 1. RockMyRun. True to its name, RockMyRun is one of the top music workout apps available. · 2. Perform. Perform matches. The PF App is a gym in your pocket. With free workout and exercise tutorials, progress tracking and more, discover the best fitness app for you! It is the best tracking app for strength training and weightlifting there is. Period. I've tried several workout apps (I even gave my man Chris Hemsworth's app. Move now! A better me is approaching! Get fit with the women workout - female fitness app! Sweat 7 mins a day to get a perfect bikini body! Best-known for its at-home indoor cycling classes, Peloton is among the most popular home fitness apps right now. And for those who like to keep a close eye on. This workout app turned up on basically every search I did for the best at home workout. It's co-created by Kayla Itsines, a mega-influencer in the fitness. Caroline Girvan is the best online trainer. I've been following her for 3 years, now repeating her free YouTube workouts. What makes a good fitness app? · An app that delivers workouts designed to help you reach your individual fitness goal. · A variety of training styles – because. Top 10 Best Fitness and Workout Apps for · C25K (Couch to 5k) is an app for beginners who need some help transforming from themselves from couch potatoes. Home workout apps are a great option for exercising · The Best Apps For Teens to Exercise At Home · Apple Fitness Plus · Nike Training Club · Yoga for Beginners. No equipment needed— unlimited access on any screen. UNLIMITED VARIETY. Get access to world's best workouts from cardio, yoga, strength. Top 15 Workout Apps For Your Fitness Goals · MyFitnessPal. MyFitnessPal, Inc. · 7 Minute Workout. Simple Design Ltd. · Nike Training Club. Nike, Inc.

What Is Web3 Technology

Web (or Web3) is a decentralized and open-source internet currently being built that aims to overcome these Web2 failures, and where users have more control. Web3 Foundation believes in an internet where: · Users own their own data, not corporations · Global digital transactions are secure · Online exchanges of. Web describes the next evolution of the World Wide Web, the user interface that provides access to documents, applications and multimedia on the internet. In this article, we will define Web3 briefly and then recommend 6 technologies with which you can improve your business. Kaleido Blockchain Business Cloud. Fully managed, full stack platform for building enterprise-grade web3 solutions quickly and cost effectively. Read more. In this article, we will define Web3 briefly and then recommend 6 technologies with which you can improve your business. The Web3, also known as the Decentralized Web, is a new technology transforming the way users experience online interactions through Digital Assets. By combining blockchain tech and peer-to-peer networking, Web3 allows you to wrestle the ownership of your data out of the hands of big tech and put it back. There is an emerging tech ecosystem that promises to revolutionize physical and digital business models: web3. Web3 is more than a singular technology. It's. Web (or Web3) is a decentralized and open-source internet currently being built that aims to overcome these Web2 failures, and where users have more control. Web3 Foundation believes in an internet where: · Users own their own data, not corporations · Global digital transactions are secure · Online exchanges of. Web describes the next evolution of the World Wide Web, the user interface that provides access to documents, applications and multimedia on the internet. In this article, we will define Web3 briefly and then recommend 6 technologies with which you can improve your business. Kaleido Blockchain Business Cloud. Fully managed, full stack platform for building enterprise-grade web3 solutions quickly and cost effectively. Read more. In this article, we will define Web3 briefly and then recommend 6 technologies with which you can improve your business. The Web3, also known as the Decentralized Web, is a new technology transforming the way users experience online interactions through Digital Assets. By combining blockchain tech and peer-to-peer networking, Web3 allows you to wrestle the ownership of your data out of the hands of big tech and put it back. There is an emerging tech ecosystem that promises to revolutionize physical and digital business models: web3. Web3 is more than a singular technology. It's.

A major advancement of Web2, the Web3 is the next-generation technology that wants a democratic and decentralized internet environment. An individual user can. Decentralized finance applications can leverage Web3 technology to provide payment and cross-user transaction services, even to people without bank accounts. Blockchain and other distributed ledger technologies play a significant role in Web3, enabling transparency and decentralisation. Cryptocurrencies and tokens. Unlike Web2, where centralized platforms dominate and collect user information, Web3 utilizes blockchain technology to create decentralized and trustless. Web3 has become a catch-all term for the vision of a new, better internet. At its core, Web3 uses blockchains, cryptocurrencies, and NFTs to give power back to. In the future, Web3 could potentially replace several traditional centralized systems and intermediaries. It has the capability to disrupt. Web3 promises a decentralised framework that will revolutionise the way companies do business. Using blockchain technology and smart contracts, Web3 offers. Ethereum co-founder Gavin Wood created the phrase “Web3” in , and the concept piqued the interest of cryptocurrency enthusiasts, huge technological. As the next generation of the internet, built on blockchain technology and decentralized protocols, It promises to be more open, fair, and. Web3 is a new stack of technologies for the development of decentralized web applications that enable users to control their own identity and data. Web3 is the next version of the internet, based on decentralized protocols and powered by blockchain technology. Web3 aspires to give people more control over. The web3 meaning captures the essence of a decentralized online ecosystem underpinned by blockchain technology. It is an umbrella term that encapsulates an. A lot of evangelists will preach it as the future of the internet, but it is not. It builds upon existing technologies on the internet, and most. The web3 meaning captures the essence of a decentralized online ecosystem underpinned by blockchain technology. It is an umbrella term that encapsulates an. Web3 is based on blockchain technology, while Web is based on semantic web technologies. To build trust and security in online interactions. Web3 Apps are decentralized applications that utilize blockchain technology to achieve benefits such as increased decentralization and privacy. In this article. The development of blockchain technology, which enables users to store, move, and exchange their data safely and transparently without the need. Web3 is the next iteration of the internet, based on decentralised technologies like blockchain, smart contracts, and artificial intelligence. Various technologies need to come together for Web to take shape, including blockchain, cryptocurrencies, smart contracts, AI, metaverses, NFTs, and more.